By Cap Puckhaber, Reno, Nevada

I’m Cap Puckhaber, a marketing professional, amateur investor, part-time blogger, and outdoor enthusiast. Today, on SimpleFinanceBlog.com, we’re going to break down the world of passive income with this comprehensive guide to passive income, with a special focus on my personal favorite: dividend investing. If you’re looking for ways to make your money work for you, especially when the economy feels a bit shaky, you’re in the right place. We’ll cover the best income-generating assets for beginners, explore high-yield investments, and give you a clear roadmap to building multiple income streams for long-term financial security.

My Journey into Passive Income

Let’s be honest, the idea of earning money while you sleep sounds pretty great, right? That’s the core of passive income. It’s not about getting rich quick; it’s about building systems that generate cash flow without requiring your constant, hands-on effort. When I first started my journey into investing, I was looking for exactly that. I explored everything from rental properties to bonds and CDs. Each has its place, but I ultimately landed on a strategy centered around a stock portfolio that offers both growth and a steady stream of income.

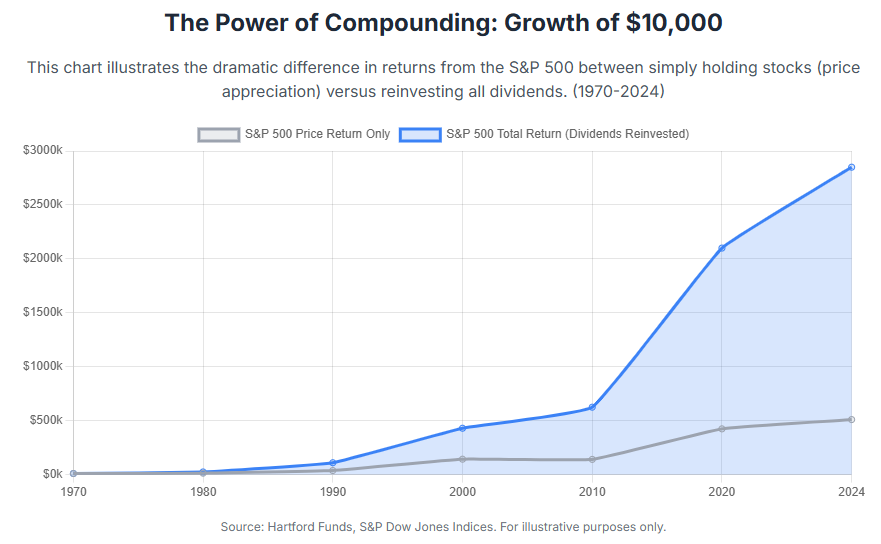

Focusing on income-producing assets gives you a sense of stability that you just don’t get from chasing high-risk, high-reward growth stocks. Think of it as a financial safety net. During market downturns, that regular cash flow can be a real comfort, and when times are good, you can reinvest those earnings to accelerate your wealth-building. It’s a powerful, balanced approach that has served me well.

The Building Blocks of Passive Income

So, where do you start? If you’re new to investing, the sheer number of options can feel overwhelming. Let’s break down some of the most accessible and effective cash flow assets for beginners with real-world numbers.

Dividend Stocks: Your Slice of the Pie

This is where I’ve chosen to focus a lot of my energy, and for good reason. When you buy a dividend-paying stock, you’re buying a small piece of a company that has decided to share its profits directly with you, its shareholder. It’s a fantastic way to generate a reliable income stream. You’ll often hear about “Dividend Aristocrats”—companies in the S&P 500 that have increased their dividends for at least 25 consecutive years. Think of giants like Coca-Cola (KO) and Procter & Gamble (PG). They are the gold standard of reliability. You can find a lot of great information on these types of stocks on sites like The Motley Fool and MarketWatch.

Bonds: The Dependable Workhorse of Income Investing

If dividend stocks are the exciting part of your portfolio, bonds are the dependable foundation. When you buy a bond, you’re lending money to an entity (a government or corporation), which promises to pay you periodic interest (the “coupon”) and return your initial investment (the “principal”) at a set maturity date. They are a cornerstone of what finance expert Dave Ramsey would consider a stable, long-term investment plan once you’re out of debt.

- Government Bonds (Treasuries): Backed by the full faith and credit of the U.S. government, these are among the safest investments on the planet. As of mid-2025, a 10-year U.S. Treasury note offers a yield of around 4.3%. This means if you invested $10,000, you’d receive about $430 in interest annually. While not a massive return, it’s incredibly secure.

- Municipal Bonds: Issued by states and cities to fund public projects, their main draw is that the interest is often exempt from federal taxes. For an investor in the 24% federal tax bracket, a municipal bond yielding 3.5% provides the same after-tax income as a taxable bond yielding about 4.6%. This “tax-equivalent yield” makes them very attractive for higher earners.

- Corporate Bonds: These are issued by companies and their yields depend heavily on the company’s creditworthiness. Bonds from a stable, blue-chip company (rated AAA, for example) might yield around 5.0%. In contrast, a bond from a less stable company (a “high-yield” or “junk” bond) might offer a tempting 7.5% yield or more, but it comes with a significantly higher risk that the company could default on its payments.

Certificates of Deposit (CDs): Secure, Fixed Returns

CDs are a straightforward, insured way to earn more interest than a standard savings account. You lock your money up with a bank for a set term, and they guarantee you a fixed interest rate. Because they are FDIC-insured up to $250,000 per depositor, your principal is safe. Right now, you can find 1-year CDs offering an Annual Percentage Yield (APY) of over 5.0%. A popular strategy is building a “CD ladder”: instead of putting all your money into one 5-year CD, you could split it into five parts, investing one part each into a 1-year, 2-year, 3-year, 4-year, and 5-year CD. As each CD matures, you can reinvest it into a new 5-year CD. This gives you regular access to a portion of your cash while allowing you to capture the typically higher rates of longer-term CDs.

A Simple 4-Step Plan for a Beginner Investor

Okay, that’s the menu of options. But if you’re a beginner, you need a recipe. Here is a simple, actionable plan to get you started on your passive income journey today.

Step 1: Define Your Goal

Before you invest a single dollar, ask yourself: “What is this money for?” Your goal will determine your strategy. Be specific. Instead of “I want to retire someday,” try “I want to generate $500 per month in passive income within the next 10 years.” This gives you a clear target to aim for and helps you track your progress.

Step 2: Open the Right Account

You’ll need a brokerage account to buy stocks, bonds, and ETFs. You can open one with firms like Vanguard, Fidelity, or Charles Schwab. If your goal is long-term retirement savings, consider opening a Roth IRA. A Roth IRA is a retirement account where your money grows tax-free, and you won’t pay any taxes on your withdrawals in retirement. This is a huge advantage for long-term compounding.

Step 3: Make Your First Investment (Keep It Simple!)

The single best starting point for most beginners is a low-cost, diversified dividend ETF (Exchange-Traded Fund). An ETF is a basket of dozens or even hundreds of stocks, so you get instant diversification without having to pick individual companies. Consider starting with one of these two highly-regarded options:

- Vanguard Dividend Appreciation ETF (VIG): This fund focuses on high-quality companies that have a history of increasing their dividends over time.

- Schwab U.S. Dividend Equity ETF (SCHD): This is another popular choice that tracks an index of 100 high-dividend-yielding U.S. stocks.

You can buy shares of these ETFs just like you would an individual stock through your brokerage account.

Step 4: Automate and Be Patient

The secret to successful long-term investing isn’t being a genius stock picker; it’s consistency. Set up automatic monthly contributions from your bank account to your brokerage account, even if it’s just $50 or $100 to start. Turn on the Dividend Reinvestment Plan (DRIP) for your ETF, which will automatically use your dividend payments to buy more shares. Then, the hardest part: be patient. Let your money work for you over the years.

Diving Deeper into Dividend Investing

Once you’ve got your foundation set with an ETF, you can start exploring individual stocks. This strategy is about more than just picking stocks with high yields; it’s about understanding the mechanics behind the payouts and building a sustainable income stream for the long haul.

Finding the Best Dividend Stocks

I spend a good amount of time on Yahoo Finance and [suspicious link removed] doing my research. Here’s what I look for:

- A History of Dividend Growth: A company that consistently increases its dividend is a sign of strong financial health.

- A Sustainable Payout Ratio: This tells you what percentage of a company’s earnings are being paid out as dividends. A ratio that’s too high might be a red flag that the dividend is unsustainable.

- Strong Fundamentals: Look for companies with solid earnings, low debt, and a strong position in their industry.

How Dividends Get Taxed

This is an important piece of the puzzle. In the U.S., dividends are taxed in one of two ways:

- Qualified Dividends: Taxed at the lower long-term capital gains rates (0%, 15%, or 20%, depending on your income). To qualify, you generally have to hold the stock for more than 60 days.

- Ordinary Dividends: Taxed at your regular income tax rate.

Understanding the tax implications is crucial, and it’s always a good idea to chat with a tax professional.

The Power of Compounding in Action

Expanding Your Income Horizons

While a dividend ETF is a great start, true financial stability comes from diversification. As you grow more confident and build your capital, you can add other assets to your portfolio.

Real Estate Investment Trusts (REITs)

Ever wanted to invest in real estate without the headache of being a landlord? That’s where REITs come in. These companies own and operate income-producing real estate, like apartment buildings and office towers. By law, they must pay out at least 90% of their taxable income to shareholders as dividends. The FTSE Nareit All Equity REITs index, a common benchmark, has delivered an average annual return of nearly 12% over the past 20 years. Many individual REITs offer yields in the 4% to 6% range, making them a powerhouse for passive income that you can buy and sell easily in your brokerage account.

Direct Real Estate Investing

This is the classic model: buying a physical property to rent out. Unlike a REIT, you have direct control, but it’s also much more hands-on. Your passive income is the rental income minus all your expenses (mortgage, property taxes, insurance, maintenance, etc.). For example, on a $300,000 rental property with a 20% down payment ($60,000), your monthly mortgage, taxes, and insurance might be around $1,800. If you can rent it for $2,200 a month, your gross cash flow is $400 per month. The big pros are that you build equity, benefit from property appreciation, and get significant tax advantages. The cons are the large upfront investment and the fact that being a landlord isn’t truly passive—it’s a part-time job.

Peer-to-Peer (P2P) Lending

Think of this as being the bank. You lend money directly to individuals through online platforms like Prosper or LendingClub. You can invest small amounts (often as little as $25) into hundreds of different personal loans and earn income from the interest payments. Historically, returns average between 5% and 7% after fees and defaults. The key is diversification across many loans to minimize the impact if one or two borrowers can’t pay you back. It’s a very passive way to earn returns that aren’t tied to the stock market, but your investment is not FDIC-insured, so there is a real risk of losing money.

Creating and Selling Digital Products

If you have a specific expertise, you can create a digital product once and sell it infinitely. This could be an e-book, an online course, or a set of design templates. This path requires a significant upfront investment of your time and skill, but once the product is created, it can generate income with very little ongoing effort. The profit margins can be extremely high since the cost to sell one more copy is essentially zero. The biggest challenge here is marketing, which is an active, not passive, endeavor.

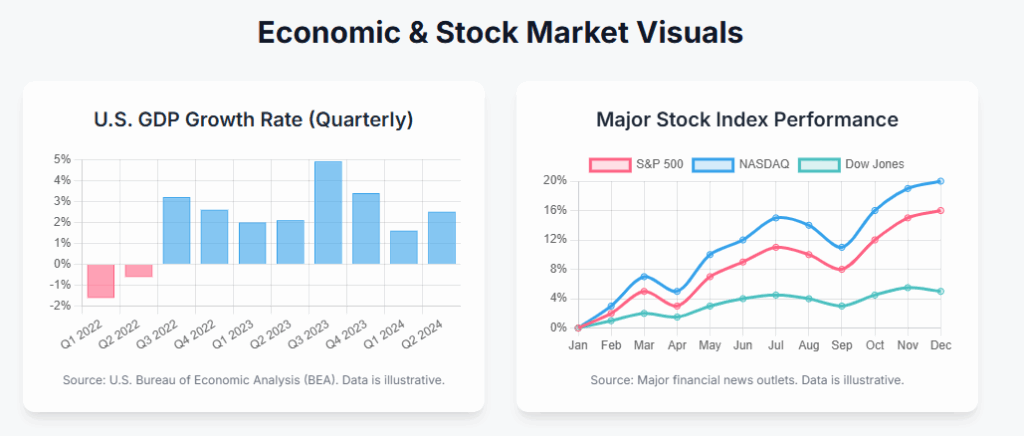

Performance of Dividend Stocks vs. The Market

For more deep dives into personal finance topics, be sure to check out more of my posts here on SimpleFinanceBlog.com.

New to Simple Finance Investing in Stocks, ETFs & Index Funds for Beginners

Cap Puckhaber’s latest take on A Beginner’s Guide to Traditional And Roth IRA

Check out my latest blog CDs vs. T-Bills: Your Complete Beginner’s Guide to Safe &; Smart Investing

New to Simple Finance Stock Valuation 101: A Beginner’s Guide to P/E Ratio & Market Cap

Investing Blog for Beginners

Hosted by Cap Puckhaber of Black Diamond Marketing Solutions, this investing blog offers daily articles on investing, savings, bonds, interest rates, mortgages, and more.

About the Founder / Author

Cap Puckhaber is a seasoned marketing strategist and finance writer, based in Reno, Nevada with over 20 years of experience investing, marketing and helping small businesses grow.

He offers expert advice on how to save for retirement, how to use a retirement calculator and the difference between T-Bills and CDs.

Cap Puckhaber shares actionable insights on how to promote your business locally for free and on trending platforms like X.

He shares his personal investment journey, how to use trade volume to predict breakouts, and his take on covered call strategies.

Follow Cap Puckhaber Online

Connect with Cap Puckhaber on Facebook

See Real-Time Thoughts on X

Read In-Depth Articles on Medium

Subscribe to Cap Puckhaber’s Substack Newsletter

Follow Cap Puckhaber’s Company Page on LinkedIn

View Our Agency Profile on DesignRush

See Cap Puckhaber’s Agency on Agency Spotter

Explore Technical Projects on GitHub

See Cap Puckhaber’s Creative Portfolio on Behance

Learn more about my company on Crunchbase

Join Cap Puckhaber’s Conversation on BlueSky

Follow My Updates on Mastodon

Backpacker, Marketer, Investor, Blogger, Husband, Dog-Dad, Golfer, Snowboarder

Cap Puckhaber is a marketing strategist, finance writer, and outdoor enthusiast from Reno, Nevada. He writes across CapPuckhaber.com, TheHikingAdventures.com, SimpleFinanceBlog.com, and BlackDiamondMarketingSolutions.com.

Follow him for honest, real-world advice backed by 20+ years of experience.