A Guide to Economic and Stock Market Performance

By Cap Puckhaber, Reno, Nevada

I’m Cap Puckhaber, a marketing professional, amateur investor, part-time blogger, and outdoor enthusiast. Today, on SimpleFinanceBlog.com, we’re breaking down the U.S. economy and the stock market’s performance to give you a clear, comprehensive guide for your ongoing investment strategy. Each year, it’s always something different, bigger, better, or worse to factor into our investing strategy. Unless you’re just “setting it and forgetting it,” you have to factor in tariffs, gold, inflation, mortgage rates, and interest rates into how you invest. It can feel like a lot, but we’ll sort through it together.

The Big Picture: Reading the Economic Dashboard

Whenever you hear news about the U.S. economy, it’s easy to get lost in the jargon. To be a smart investor, you need to know what the key metrics mean and, more importantly, what numbers signal “good” or “bad” news for your portfolio.

Think of the economy’s health as a check-up. Doctors don’t just take your temperature; they look at your blood pressure, heart rate, and a bunch of other things. Similarly, economists look at several key indicators.

Gross Domestic Product (GDP):

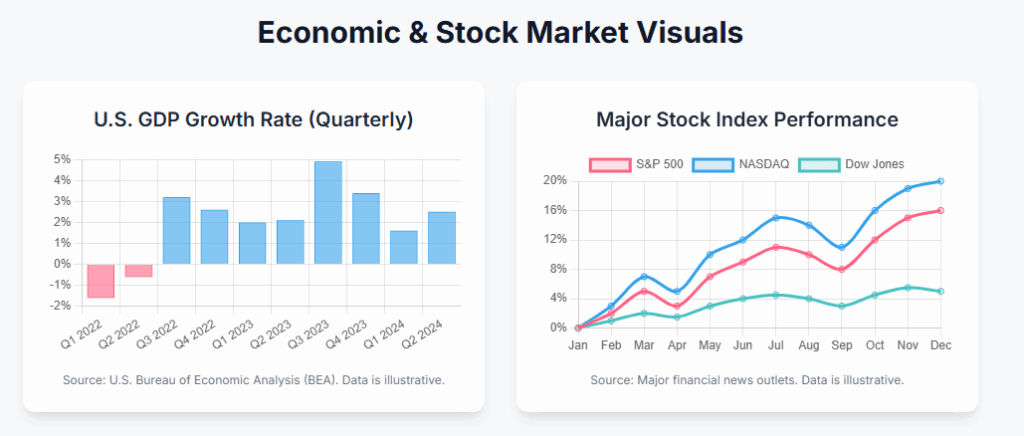

- This is the big one. GDP measures the total value of all goods and services produced in the country.

- What to look for: A healthy, sustainable GDP growth rate is typically considered to be between 2% and 3% annually. Growth above 4% can be great in the short term but may lead to inflation if it lasts too long. A couple of consecutive quarters of negative GDP growth is the technical definition of a recession.

- Market Correlation: A strong GDP report is generally bullish for the stock market. It signals that companies are earning more, which often leads to higher stock prices. Conversely, shrinking GDP is a major red flag for investors.

The Labor Market (Unemployment Rate):

- The unemployment rate tells us what percentage of the labor force is jobless but actively looking for work.

Purchasing Managers’ Index (PMI):

- This one sounds complicated, but it’s a fantastic forward-looking indicator. The PMI is a monthly survey of purchasing managers in the manufacturing and services sectors.

- What to look for: The key number is 50. A reading above 50 indicates that the sector is expanding, while a reading below 50 suggests it’s contracting. A reading of 55 or higher shows robust growth, while a sustained drop below 45 often precedes a recession.

- Market Correlation: Because it’s a forward-looking indicator, the market reacts strongly to PMI data. A surprise jump in the PMI can send markets higher, as it suggests strong future earnings.

Consumer Confidence Index (CCI):

- This measures how optimistic consumers are about their financial situation and the economy.

- What to look for: The baseline for this index is 100. A reading significantly above 100 indicates strong optimism, which usually translates to higher spending. A reading below 90 signals pessimism.

- Market Correlation: Since consumer spending makes up about 70% of U.S. GDP, this is a huge deal. High confidence is bullish for retail, travel, and other consumer-focused stocks.

The Federal Reserve, Inflation, and Your Money

You can’t talk about the economy without talking about the Federal Reserve (the Fed). The Fed’s main job is to manage the nation’s money supply to achieve two goals: maximum employment and stable prices (i.e., controlling inflation). Their primary tool is the federal funds rate, which is the interest rate at which banks lend to each other overnight.

Historically, this rate has been all over the place. In the early 1980s, to combat runaway inflation, it was pushed as high as 20%! In the aftermath of the 2008 financial crisis and during the COVID-19 pandemic, it was lowered to near zero to stimulate the economy. The Fed’s target for inflation is typically around 2%. If inflation runs much higher than that, the Fed will raise interest rates to cool down the economy.

How do interest rates affect the stock market? There is generally an inverse correlation.

- When rates rise: Borrowing money becomes more expensive for companies, which can hurt their profits. It also makes “safer” investments like bonds and high-yield savings accounts more attractive. Why take the risk of stocks when you can get a decent, guaranteed return from a bond? This tends to pull money out of the stock market, causing prices to fall or stagnate.

- When rates fall: Borrowing becomes cheaper, encouraging businesses to invest and expand. Bonds become less attractive, pushing investors toward stocks in search of higher returns. This is generally bullish for the stock market.

The Stock Market Rollercoaster: Bulls, Bears, and You

The stock market has its own language. You’ll constantly hear about “bull” and “bear” markets. Understanding what they are and how to behave in each is critical.

- A Bull Market is a period of generally rising prices and investor optimism. Technically, it’s often defined as a 20% rise in a major index (like the S&P 500) from its recent lows. In a bull market, the economy is typically strong, and unemployment is low. The strategy is often focused on growth.

- A Bear Market is the opposite: a period of falling prices and widespread pessimism. It’s defined as a 20% drop from recent highs. Bear markets are often, but not always, associated with recessions. The strategy here shifts to capital preservation and finding value.

How should you invest in each? In a roaring bull market, growth-oriented stocks, particularly in the technology and consumer discretionary sectors, tend to perform very well. The temptation is to get greedy, but it’s important to stick to your plan and not chase “hot” stocks without doing your homework.

In a bear market, the focus shifts. This is where defensive stocks (healthcare, utilities, consumer staples) shine because people still need their products and services. It’s also a fantastic time for long-term investors to practice dollar-cost averaging—continuing to invest a fixed amount regularly. When the market is down, your dollars buy more shares. It feels scary, but buying during a bear market is how fortunes are often made.

Your Game Plan: Building a Resilient Portfolio

So, what should you do with all this information? Building a solid investment strategy isn’t about timing the market perfectly; it’s about creating a plan that can withstand the market’s inevitable ups and downs.

Diversify with a Purpose

Saying “diversify” is easy. Doing it right takes a plan. Diversification means spreading your money across different asset classes that don’t always move in the same direction. Here’s a tangible example of what a diversified portfolio might look like for an investor in their 30s with a moderate risk tolerance:

- 60% Stocks:

- 35% in a U.S. Total Stock Market ETF (like VTI or SCHB)

- 15% in an International Total Stock Market ETF (like VXUS or IXUS)

- 10% in a U.S. Small-Cap Value ETF (like VBR or AVUV) for added growth potential.

- 30% Bonds:

- 30% in a Total Bond Market ETF (like BND or AGG) for stability.

- 10% Alternatives:

- 10% in a Real Estate ETF (like VNQ) for inflation protection and a different return stream.

This is just an example. Your allocation should depend on your age, goals, and risk tolerance. A younger investor might have 80% or more in stocks, while someone nearing retirement might have 50% or more in bonds.

How to Find “Quality Companies”

A “quality” company isn’t just a brand you like; it’s a business with strong, measurable financial health. When you’re looking at an individual stock, here are a few key metrics to check using a site like Yahoo Finance or Morningstar:

- Return on Equity (ROE): This measures how efficiently a company uses shareholder investments to generate profit. Look for a consistent ROE above 15%.

- Debt-to-Equity Ratio: This compares a company’s total debt to its total shareholder equity. It shows how much the company relies on borrowing. Look for a ratio below 1.0, although this can vary by industry. A lower number is almost always better.

- Price-to-Earnings (P/E) Ratio: This is a classic valuation metric that compares the company’s stock price to its earnings per share. A high P/E can mean a stock is overvalued, while a low P/E might signal a bargain. There is no magic number, but you should compare a company’s P/E to its own historical average and to its direct competitors.

- Free Cash Flow (FCF): This is the cash a company generates after paying for its operating expenses and capital expenditures. Positive and growing FCF is a fantastic sign. It means the company has cash to pay down debt, pay dividends, or invest in growth.

FAQ Recommendations

- What is a healthy GDP growth rate for the U.S. economy? A healthy, sustainable GDP growth rate is typically between 2% and 3% annually. Growth exceeding 4% can be beneficial short-term but may lead to inflation if sustained.

- How do rising interest rates affect the stock market? Generally, there is an inverse correlation. When the Federal Reserve raises rates, borrowing becomes more expensive for companies, which can lower profits and often leads to a decline or stagnation in stock prices.

- What is the difference between a Bull Market and a Bear Market? A Bull Market is characterized by rising prices and optimism (a 20% rise from recent lows). A Bear Market is defined by falling prices and pessimism (a 20% drop from recent highs).

- What metrics define a “quality” company for investment? Investors look for a consistent Return on Equity (ROE) above 15%, a Debt-to-Equity ratio below 1.0, positive Free Cash Flow, and a reasonable Price-to-Earnings (P/E) ratio compared to industry peers.

- What is the “technical” definition of a recession? A recession is technically defined as two consecutive quarters of negative Gross Domestic Product (GDP) growth.

The Bottom Line

Navigating the economy and the stock market can feel complex, but it boils down to a few key principles. Understand the big economic signals, know the difference between a bull and a bear, and build a resilient, diversified portfolio of quality assets. Most importantly, control your own psychology and focus on the long term. The market will have its ups and downs, but a disciplined, informed approach is the surest path to building wealth.

For more tips and in-depth analysis, be sure to check out Investopedia, a fantastic resource for investors of all levels.

Thanks for reading, and I hope this guide helps you feel more confident about your financial future.

How the Fed, Inflation, and Rates Affect Your Investments

How Politics and Elections Impact the Stock Market

About the Founder / Author

Cap Puckhaber is a seasoned marketing strategist and finance writer, based in Reno, Nevada with over 20 years of experience investing, marketing and helping small businesses grow.

He offers expert advice on how to save for retirement, how to use a retirement calculator and the difference between T-Bills and CDs.

Cap Puckhaber shares actionable insights on how to promote your business locally for free and on trending platforms like X.

He shares his personal investment journey, how to use trade volume to predict breakouts, and his take on covered call strategies.

Investing Blog for Beginners

Hosted by Cap Puckhaber of Black Diamond Marketing Solutions, this investing blog offers daily articles on investing, savings, bonds, interest rates, mortgages, and more.

Backpacker, Marketer, Investor, Blogger, Husband, Dog-Dad, Golfer, Snowboarder

Cap Puckhaber is a marketing strategist, finance writer, and outdoor enthusiast from Reno, Nevada. He writes across CapPuckhaber.com, TheHikingAdventures.com, SimpleFinanceBlog.com, and BlackDiamondMarketingSolutions.com.

Follow him for honest, real-world advice backed by 20+ years of experience.

Follow Cap Puckhaber Online

- Join the Team on Wellfound

- Connect with Cap Puckhaber on Facebook

- See Real-Time Thoughts on X

- Read In-Depth Articles on Medium

- Subscribe to Cap Puckhaber’s Substack Newsletter

- Follow Cap Puckhaber’s Company Page on LinkedIn

- View Our Agency Profile on DesignRush

- See Cap Puckhaber’s Agency on Agency Spotter

- Explore Technical Projects on GitHub

- See Cap Puckhaber’s Creative Portfolio on Behance

- Learn more about my company on Crunchbase

- Cap Puckhaber’s Quora Profile

- Join Cap Puckhaber’s Conversation on BlueSky

- Follow My Updates on Mastodon